Payment Screening Maximize global risk coverage with low latency and high accuracy

Automatically screen payments to identify and prevent suspicious transactions, using powerful matching technology from Hawk.

Hawk's Payment Screening helps you identify and prevent suspicious payments

Screen payments automatically against sanctions and other lists

Support fast payments with screening in an average of 150 milliseconds

Flexible list management to combine internal and external data

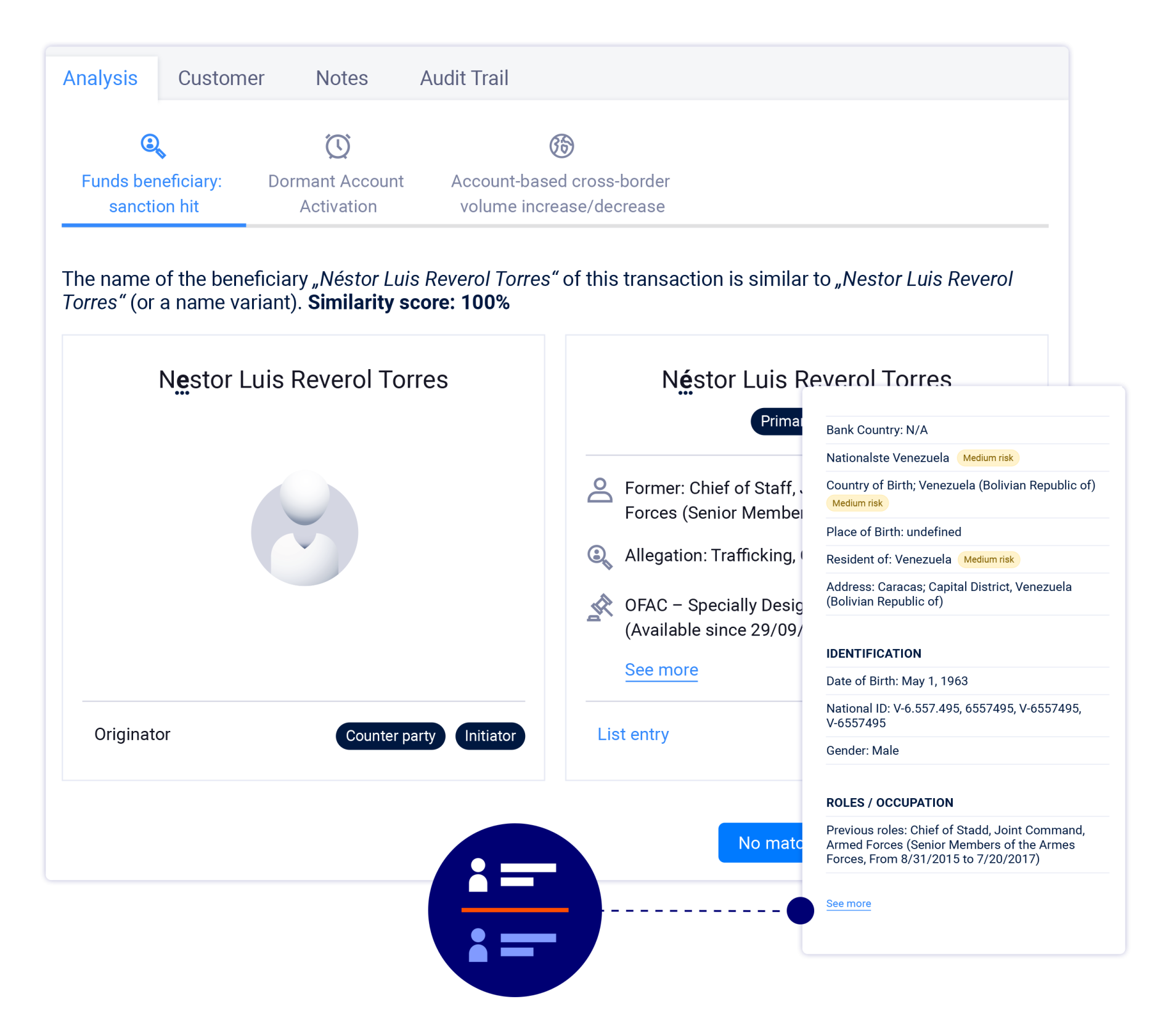

Provide analysts with fast, accurate decision-making capability

High accuracy with low false positives

Hawk's Payment Screening solution considers context, picking from the best phonetic and spelling matches to deliver the most accurate results.

A holistic financial crime solution

Payment Screening from Hawk is part of a comprehensive financial crime platform. Seamless integration of Payment Screening with other modules, including Transaction Monitoring, Customer Screening, Customer Risk Rating, and Transaction Fraud Detection enables maximum effectiveness and efficiency in your operation.

Simplify tasks with unified Case Manager

Bring data together in one interface to enable analysts to rapidly and thoroughly inspect cases without switching systems. Quickly identify the reason for the alert and find possible courses of action. The Dashboard view produces additional top-down insights on monitoring activity. This allows you to rapidly identify issues with workload, hit handling performance, or case backlog.

A complete Payment Screening solution

Next steps to enhance your Payment Screening

Discover how Hawk helps you detect and prevent suspicious payment activity